CA DE 428C 2021-2024 free printable template

Show details

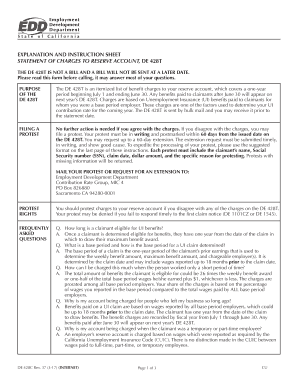

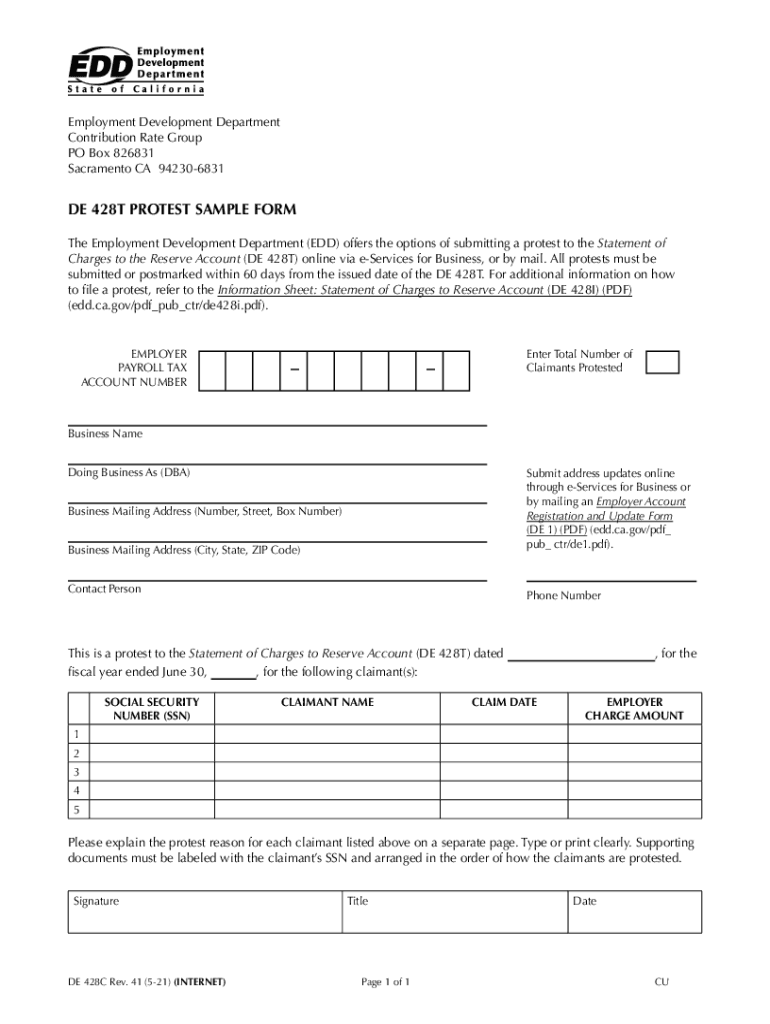

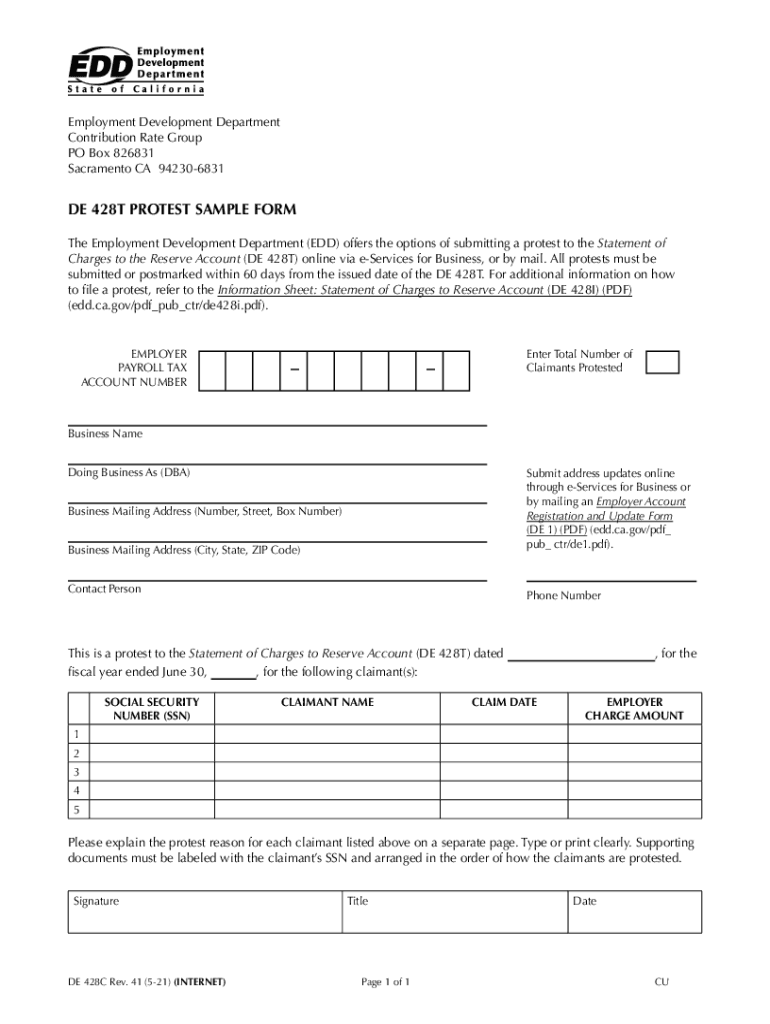

EXPLANATION AND INSTRUCTION SHEET STATEMENT OF CHARGES TO RESERVE ACCOUNT DE 428T THE DE 428T IS NOT A BILL AND A BILL WILL NOT BE SENT AT A LATER DATE. Please read this form before calling it may answer most of your questions. PURPOSE OF THE DE 428T The DE 428T is an itemized list of benefit charges to your reserve account which covers a one-year period beginning July 1 and ending June 30. PGM CODE For EDD use only. WHERE TO CALL For assistance or questions regarding the DE 428T please call...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your de 428c 2021-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de 428c 2021-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit de 428c online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit de428c form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

CA DE 428C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out de 428c 2021-2024 form

How to fill out de 428c:

01

Start by gathering all relevant information such as personal details, income statements, and any supporting documents related to tax deductions or credits.

02

Download the de 428c form from the official website of the government agency responsible for tax filings, or obtain a physical copy from a local tax office.

03

Make sure to carefully read the instructions provided with the form to understand the requirements and specific sections that need to be filled out.

04

Begin filling out the form by entering your personal information, including your name, address, social security number, and any other requested details.

05

Move on to the income section, where you will need to report your earnings from various sources such as employment, investments, or self-employment. Provide accurate and up-to-date figures for each income source asked for in the form.

06

If applicable, include any deductions or credits that you are eligible for. These may include expenses related to education, health care, or homeownership. Provide the necessary supporting documentation for each deduction or credit claimed.

07

Check and double-check all information provided in the form to ensure accuracy and completeness. Any mistakes or missing information can lead to delays in processing or even penalties.

08

Once you are satisfied with the completed form, sign and date it as required. Keep a copy for your records before submitting it.

09

Depending on your location and filing preferences, you may need to mail the completed de 428c form to the appropriate tax office or submit it electronically through an online platform.

Who needs de 428c:

01

Individuals who are required to file a tax return and meet the specific criteria set by the tax authority.

02

Individuals who have earned income from various sources and need to report it to the tax authority.

03

Individuals who are eligible for deductions or credits that are accounted for in the de 428c form.

04

Anyone who wants to comply with their tax obligations and ensure they are accurately reporting their income and claiming any applicable deductions or credits.

Video instructions and help with filling out and completing de 428c

Instructions and Help about de 428c instruction pdf form

Fill de 428c sheet edit : Try Risk Free

People Also Ask about de 428c

How do I apply for baby bonding time in California?

Can I print EDD forms?

How do I get my EDD medical provider form?

Can you print EDD forms online?

What is a proof of relationship document for EDD?

Where can I get de 2501F form?

How to fill out California DE4 2022?

Where can I get California state disability forms?

Can I print the DE 2501 form?

How can I get form DE 2501?

What is the best time to call EDD Disability?

Do I have to fill out a de4 form?

What form does my doctor have to fill out for disability in California?

How many allowances should I claim California de4?

How long is baby bonding in California 2022?

How do I submit my medical provider form to EDD online?

Where can I get an EDD disability form?

How do I file a California state disability claim?

What is California tax form DE 4?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file de 428c?

Form DE 428C is a California form that is required to be filed by certain individuals who are claiming the Head of Household filing status on their state income tax return. To be eligible to file as Head of Household, you must meet specific criteria, including being unmarried or considered unmarried on the last day of the tax year and paying more than half the cost of maintaining a home for yourself and a qualifying person. The form requires you to provide information about your living situation, dependents, and expenses to determine your eligibility for the Head of Household status.

How to fill out de 428c?

To properly fill out form DE 428C (California Child Support Calculation), follow these steps:

1. Begin by entering your personal information in the top section of the form. This includes your full name, address, telephone number, Social Security Number (SSN), and the case number (if applicable).

2. In Section A, provide details about your income. Start with your gross monthly wages, salary, or earnings. If you receive any additional income, such as bonuses, commissions, or overtime, include that as well. Follow the instructions carefully to ensure accurate reporting.

3. Section B is dedicated to your deductions. List any mandatory deductions from your income, such as federal and state taxes, Social Security, Medicare, and employee retirement contributions.

4. In Section C, input information about the other parent's income. If you are unaware of their income, you may need to estimate it to the best of your knowledge. Include their gross monthly wages, salary, or earnings in this section. If applicable, add their additional income, just like in Section A.

5. Similar to Section B, Section D is for documenting the other parent's deductions. Note any mandatory deductions, such as taxes and retirement contributions for the other parent.

6. Next, proceed to Section E, where you will enter information related to the child(ren). Include the name and date of birth of each child for whom support is being calculated.

7. In Section F, provide details about health care premiums paid for the children you listed in Section E. Here, you need to mention the amount you, as the completing parent, pay for the health insurance coverage of the child(ren). If you do not have health care plan coverage for your child(ren), leave this section blank.

8. Section G is meant for daycare or child care expenses. If you contribute to the cost of daycare, fill out this section accordingly. Include the monthly amount you pay and identify the child(ren) who benefit from these expenses.

9. Finally, at the bottom of the form, sign and date it. If applicable, have the other parent sign as well.

Always remember to review the completed form for accuracy and completeness before submitting it. If you have any doubts or questions, consider consulting with a legal professional or contacting the appropriate authority in your area for guidance.

What information must be reported on de 428c?

The form DE 428C, also known as the California Employee Withholding Certificate, is used to determine the amount of state income tax to be withheld from an employee's wages in California. The information that must be reported on form DE 428C includes:

1. Personal Information: The employee's full name, social security number or individual taxpayer identification number, home address, and contact details.

2. Filing Status: The employee's designated filing status, such as single, married, head of household, etc. This determines the tax brackets and withholding rates applicable to the individual.

3. Exemptions: The number of allowances the employee is claiming. An allowance represents a reduction in the amount of income subject to withholding. This number depends on personal circumstances (e.g., number of dependents) and can vary from zero to a higher number.

4. Additional Withholding: If the employee wants to request an additional amount of tax to be withheld from each paycheck, they can specify this in this section.

5. Signature: The form must be signed and dated by the employee, verifying that the information provided is accurate.

It is important for both employers and employees to ensure that the information reported on form DE 428C is correct to ensure accurate withholding of state income tax.

When is the deadline to file de 428c in 2023?

I apologize, but I could not find specific information regarding a form called "DE 428c" with relevance to a deadline in 2023. The form may vary depending on the country or jurisdiction you are referring to. Can you please provide more context or specify the country or jurisdiction you are inquiring about?

What is the penalty for the late filing of de 428c?

The penalty for late filing of Form DE 428C depends on the specific regulations and guidelines provided by the tax authorities in your jurisdiction. Form DE 428C is specific to the state of California, but without further information such as the tax year in question, it is challenging to provide an accurate penalty amount. It is advisable to consult the official California tax website or contact the tax authority directly for specific penalties regarding late filing of Form DE 428C.

How do I fill out the de 428c form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign de428c form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete de 428t protest form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your 428t. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit de 428t protest sample form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 428c sheet printable form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your de 428c 2021-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De 428t Protest Form is not the form you're looking for?Search for another form here.

Keywords relevant to de 428c sheet printable form

Related to de428c sheet blank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.